Disclaimers

For 2025, CMS requires the reinstatement of the 48-hour Scope of Appointment (SOA) time frame, which prohibits personal marketing appointments from taking place until at least 48 hours after a potential enrollee completes an SOA. SOAs must be obtained a minimum of 48 hours in advance and remain valid for six months from the beneficiary’s signature date.

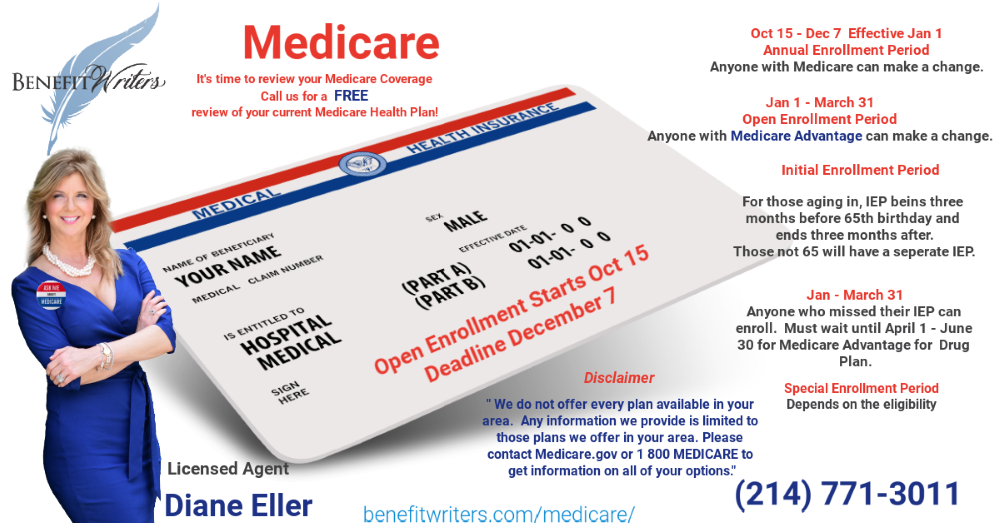

We do not offer every plan available in your area. Any information we provide is limited to the plans we offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to obtain information on all of your available options.

All calls are required to be recorded and maintained for ten (10) years in accordance with Medicare and Medicaid requirements. If you do not wish to have your call recorded, the call may cease. This requirement applies to all Medicare Advantage and Part D products.

What Is Medicare?

Medicare is the federal health insurance program for:

- Individuals 65 or older

- Certain people under 65 with qualifying disabilities

- People with End-Stage Renal Disease (ESRD)

Some individuals who continue working past age 65 and have creditable employer coverage may be able to delay enrollment without penalty.

Medicare Enrollment Rockwall Texas - Benefit Writers Can Help

Whether you’re new to Medicare, getting ready to turn 65, or preparing to retire, you’ll need to make several important decisions about your health coverage. If you wait to enroll, you may have to pay a penalty, and you may have a gap in coverage. Use these steps to gather information so you can make informed decisions about your Medicare:

Step 1: Understanding the Parts of Medicare

The different parts of Medicare help cover specific services.

Medicare Part A – Hospital Insurance

Covers:

-

-

- Inpatient hospital care

- Skilled nursing facility care

- Hospice services

- Limited home health care

-

Most beneficiaries qualify for premium-free Part A.

Medicare Part B – Medical Insurance

Covers:

-

-

- Doctor visits

- Outpatient care

- Preventive services

- Durable medical equipment

-

Part B requires a monthly premium, which is income-based.

Medicare Part C – Medicare Advantage

Medicare Advantage Plans are offered by private insurance companies approved by Medicare and provide:

-

-

- All Part A and Part B benefits

- Often include prescription drug coverage

- Plans such as HMO, PPO, and Special Needs Plans

-

Medicare Part D – Prescription Drug Coverage

Medicare Part D helps cover the cost of prescription medications and can be added to:

-

-

- Original Medicare (Part A & B)

- Certain Medicare Advantage Plans

- Some Medicare Cost or MSA Plans

-

Step 2: Understand When You Can Enroll

What Are The Ages I Can Qualify?

There are specific times when you can enroll in Medicare. Depending on the situation, some people may get Medicare automatically, and others need to apply for Medicare.

Your first opportunity is your Initial Enrollment Period (IEP), which lasts 7 months:

- Begins 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you don’t enroll when first eligible:

- You may pay a late enrollment penalty (especially for Part B)

- You may experience a gap in coverage

Step 3: Decide if you want Part A and Part B

Most people should enroll in Part A when they turn 65, even if they have health insurance from an employer. This is because most people paid Medicare taxes while they worked so they don't pay a monthly premium for Part A. Certain people may choose to delay Part B. In most cases, it depends on the type of health coverage you may have. Everyone pays a monthly premium for Part B. The premium varies depending on your income and when you enroll in Part B. Most people will pay the standard premium amount of $206.50 in 2026.

Learn more about whether you should take Part A and Part B.

Step 4: Choose your coverage

If you decide you want Part A and Part B, there are 2 main ways to get your Medicare coverage — Original Medicare or a Medicare Advantage Plan (like an HMO or PPO). Some people get additional coverage, like Medicare prescription drug coverage or Medicare Supplement Insurance (Medigap). Most people who are still working and have employer coverage don’t need additional coverage. Learn about these coverage choices.

Step 5: Sign up for Medicare (Unless you’ll get it automatically)

Some people automatically get Part A and Part B. Find out if you’ll get Part A and B automatically.

If you're automatically enrolled, you'll get your red, white, and blue Medicare card in the mail

- 3 months before your 65th birthday, or

- In your 25th month of disability benefits

If you don't get Medicare automatically, you’ll need to apply for Medicare online.

Step 6: Learn the Key Tasks for Your First Year on Medicare

Your first year may include:

- Choosing or changing a health plan

- Selecting prescription drug coverage

- Understanding costs and benefits

- Reviewing annual notices and coverage changes

Learn about 4 tasks for your first year.

Not sure what kind of coverage you have?

- Check your red, white, and blue Medicare card

- Check all other insurance cards that you use

- Call the phone number listed on the insurance cards to get more information about the coverage

- Check your Medicare health or drug plan enrollment

Prescription Drug Coverage Options

How to get drug coverage

You can get drug coverage in one of two ways:

- Enroll in a Medicare Part D plan

- Choose a Medicare Advantage Plan that includes drug coverage (like an HMO or PPO)

What drug plans cover

Learn what Medicare drug plans cover, including information about a drug formulary and tiers.

Costs for drug coverage

Learn about the types of costs you’ll pay in a Medicare drug plan.

Joining a health or drug plan

Find out when you can sign up for or change your coverage. This includes your Medicare Advantage Plan (Part C) or Medicare Prescription Drug Coverage (Part D).

How Part D works with other insurance

Learn about how Medicare Part D (prescription drug coverage) works with other coverage, like employer or union health coverage.

Click To Find health & drug plans

Find and compare drug plans, health plans, and Medicare Supplement Insurance (Medigap) policies.

Related Resources

Helpful Medicare Resources

- Medicare & You - The Official US government Medicare Handbook

- Parts of Medicare

- Medigap & Medicare drug coverage (Part D)

Still Have Questions about Medicare?

Let Diane Eller Help You Feel More Comfortable

Call Now: 214-771-3011

Important Compliance Notice

Note: For 2025, CMS has proposed to reinstate the 48-hour Scope of

Appointment (SOA) time frame, prohibiting personal marketing

appointments from taking place until 48 hours after a potential

enrollee completes an SOA. Under the new rule, SOAs will need to

be obtained at least 48 hours in advance and will remain valid for six

months from the beneficiary's signature date.

WHAT OUR CLIENTS SAY

Diane was extremely helpful in getting me set up and trained to use the numerous tools offered by Benefit Writers. Great customer service and quick response!

Diane is not only a professional in the Benefits and Insurance world but also serves her clients with passion. The one thing that always stands out is her willingness to help her clients no matter what they need. I have enjoyed being associated with her personally and through the National Association of Health Underwriters. It takes a special person to give of their time and talents while helping her clients and being a Wife, Mother, and Grandmother at the same time. That is what sets her apart from other people in our industry.

I had the pleasure of working with Diane and her clients for approximately two years. Diane is great at building client relationships and making appropriate product recommendations that fit each client's needs. She is very knowledgeable about HSA products and a variety of other insurance products. I highly recommend working with her as your agent.

Diane offers her industry experience wrapped with a solution to meet the needs, no matter how small or large; she is your defense and tackle to make that touchdown. She is very diverse and always looking for solutions while making things happen. She is an excellent industry leader and is willing to get the job done. I highly recommend Diane.

Diane is dedicated to getting the job done right the first time. Whether she is working for a client or working on a committee, her energy and creativity are limitless in bringing the project to a successful conclusion.